Beating the Decline: Expert Recommendations to Overcome the U.K.'s Reputation Recession

Corporate Reputation23 Nov, 2023

The U.K. has, so far, narrowly avoided an economic recession, having rather been in a period defined by economists as "two consecutive quarters of economic contraction." But RepTrak's reputation tracking technology and expert analysts have detected a recession of another type in the U.K. — a corporate reputation recession.

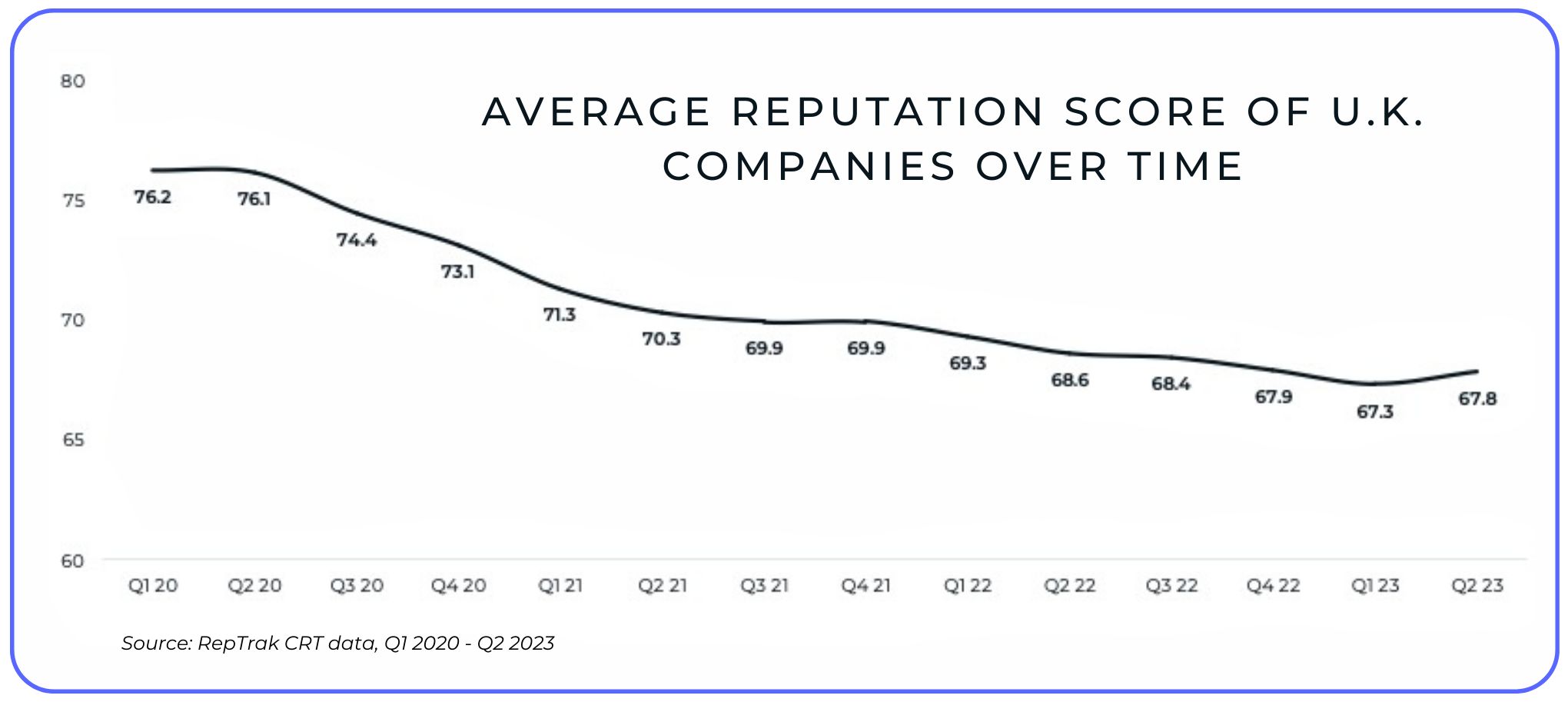

RepTrak monitors the corporate reputation of 100+ companies in the U.K. across many sectors — and a clear and persistent decline is ringing reputation alarms. In Q2 2020, at the onset of the pandemic, the average Reputation Score in the U.K. was a Strong (and impressive) 76.1. By Q2 2023, that had fallen significantly to an Average 67.8. The U.K. has seen multiple consecutive quarters of a reputation decline — sadly meeting the definition of a recession.

What caused the decline?

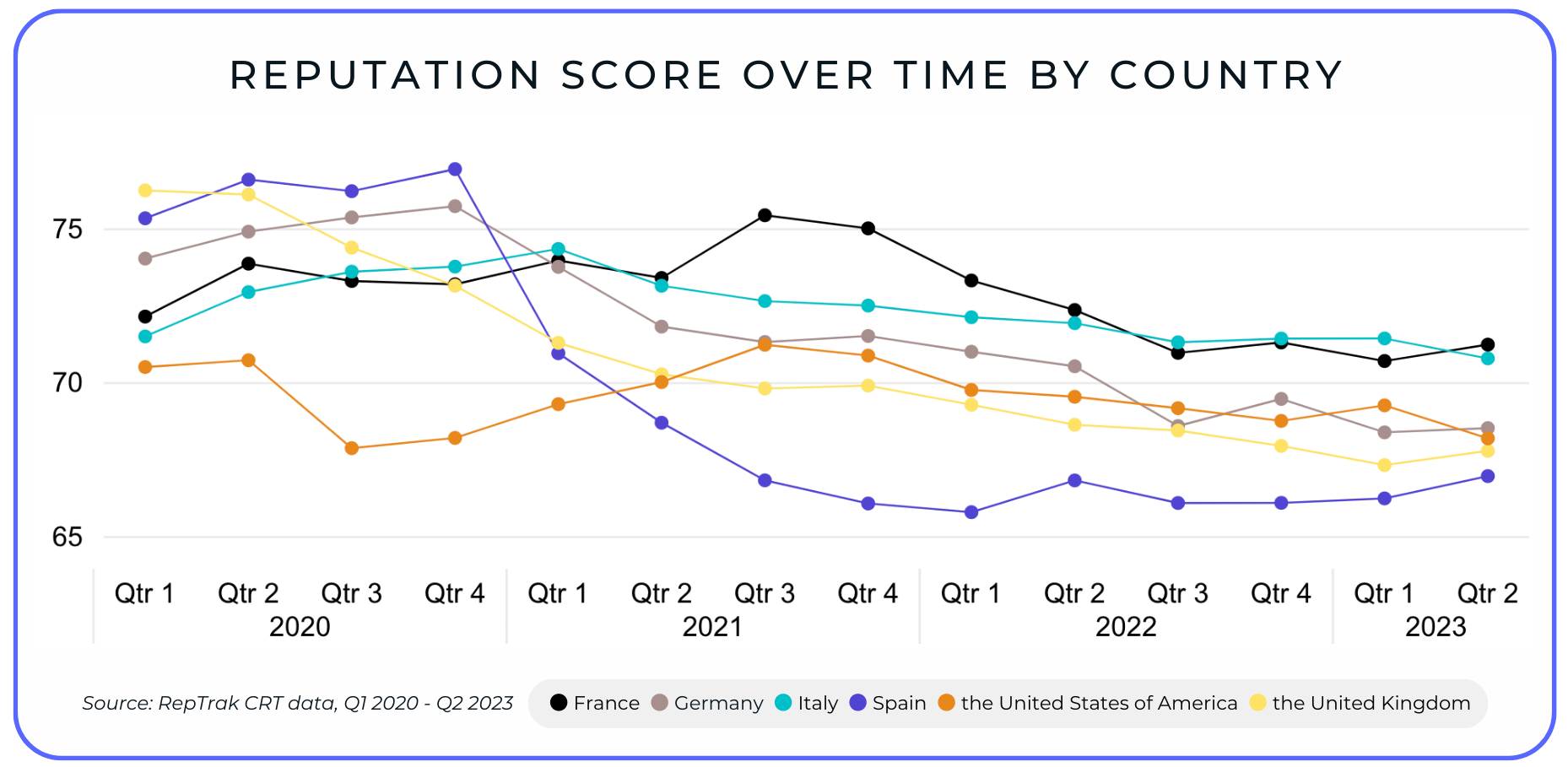

International comparisons make what’s happened in the U.K. clearer and starker. While business in the U.K. used to have a better Reputation than the U.S. and other major European economies, today the U.K. has fallen behind France, Italy, Germany and the U.S. Only Spain continues to see weaker average Reputation Scores than the U.K.

U.K. business responded well during the initial stages of the COVID pandemic, yet, the existence of COVID alone doesn’t explain the decline. Instead, we see multiple overlapping and interacting trends:

While COVID didn’t immediately cause a decline, it’s long-term impacts have hurt business. From the "great resignation" making it harder to retain and attract talent, to the uncertainty caused by changing public health restrictions — the pandemic took a toll on both the general public and business operations at large.

No sooner had business adjusted from pandemic driven issues, Russia’s invasion of Ukraine sent a second shockwave through U.K. commerce. Companies faced difficult decisions about how to handle Russian subsidiaries (and criticism if action wasn’t in line with public expectation), supply chain disruptions, and soaring energy prices.

What began as rising energy prices soon morphed into inflationary measures in the U.K. Our data shows that offering high quality products and services for a good value is a key Driver of Reputation. With prices rising, few may wonder why attitudes towards business hardened. At the same time, businesses themselves faced inflation with marketing and communications budgets squeezed.

The U.K. has also faced unique instability caused by Brexit. Business thrives on certainty, and rapid changes in political leadership, shifts in economic policy, and the pain of transitioning business to existing outside of the European Union are all distractions and disruptions.

Public concern on ESG topics, like climate change and sustainability, continues to rise. The U.K.’s Advertising Standards Authority is clamping down on excessive claims — they're on high alert for "greenwashing." With stakeholders becoming increasingly knowledgeable and savvy, what has previously looked good is evolving quickly.

The consequences of a falling reputation

At RepTrak, we advocate for the benefits of having a good reputation — and we like to celebrate reputation success. Decades of data and real world experience tells us that a good reputation is: a tool for customer retention, an aid to attracting the best talent, and a powerful way to gain trust and the benefit of the doubt.

A 5-point improvement in Reputation Score typically increases willingness to Buy and Recommend a company’s products and services by 6%. Companies with an Excellent Reputation find it easier to attract talent too – 66% would work for a top reputation tier company.

As reputation falls in the U.K., these benefits are lost and the consequences are prevalent. Looking at the retail sector, there have been countless business failures in recent years: Debenhams, Cath Kidston, Made.com, Paperchase, Arcadia, Misguided, Joules, and Wilko. While some live on with new owners or in a new form, none have the presence or reputation they once did.

Some companies are standing out

In any recession, be it economic or reputation, businesses must innovate and adapt. While most decline, the best improve. This is exactly what we see in the U.K.

In the U.K., and elsewhere in Europe, the Swedish retailer’s Reputation is improving. While its flat pack, low prices are in tune with public demand for value, the company is also progressing on other reputational measures. It is credited both for innovation and for having a positive societal impact through its environmental and sustainability work.

While Ikea might be thought of as a value player, higher-end companies like Bosch, Sony and Canon are making progress too. Long a byword for quality, these companies adapted to changing stakeholder demands and are active on new fronts. Not only are they working to tackle climate change, but they're communicating their ESG efforts with consumers.

Even in the most reputationally challenged sectors, like Energy, it's possible to see companies standout. Octopus sets itself apart through an open and transparent communications approach (using the CEO in candid communications for example). It also cleverly uses third party awards and accreditations to help build trust in a poorly perceived sector.

These are five very different businesses, building their reputations in different ways, but, two things link them. First: they are focused on what matters. Dozens of different topics drive a company’s Reputation, but they don’t all matter equally for every company. In the U.K., our data shows Products & Services (quality, value, service) is the top Driver, followed by Conduct (ethics, fairness, transparency) and Citizenship (societal contribution, support for good causes, environmental protection). All these well-performing companies are active in these areas and working to improve their performance further. Second: they aren’t shy in sharing the good news. They are proactive in using a wide range of channels (paid, owned, earned, and direct) in getting their messages to stakeholders. While classic products and services messaging remains commercially and reputationally important, they’ve added good citizenship and conduct stories to their communications mix too.

Lessons for a 2024 recovery

No downturn lasts forever. For companies looking to recover their reputations in the new year, we offer these three recommendations to get your strategy planning started:

Be clear on your goals, as this will determine your actions and comms strategy. Reputation is a means to an end. A good reputation is a tool for achieving wider business goals, not an end in itself. Building reputation to attract and retain talent is different from building a license to operate ahead of a planned merger. Depending on the end goal, the "right" reputation topics, channels, and messages will vary.

Align activity around what matters. What matters to one audience doesn’t always matter to another. What matters in the U.K. doesn’t always matter in another market. Internal resources and external stakeholder attention is always scarce. Focus action on those areas which matter most – and where the company has a credible, engaging story to tell.

Tell stakeholders the good news. Few members of the public or stakeholders actively research companies. Companies must take their message to the audience, using the right channels for the right audience. Those channels that have worked in the past may not be the most appropriate or cost effective now.

Of course, we also recommend finding a reputation monitoring tool — we'd recommend RepTrak. If you're ready to beat the reputation decline, schedule a demo today.

By Laurence Stellings

Laurence Stellings is SVP in RepTrak's Global Advisory team. His work focuses on complex multi-country and multi-stakeholder programs, advising clients on how to use reputation to achieve their business and commercial goals. Prior to joining RepTrak, he worked as a political pollster and in elite stakeholder management.