Retail: The echoes of 2020 are infiltrating 2021 reputation

Corporate Responsibility/ESG15 Nov, 2021

We’re 23 months into 2020, or at least it feels that way. RepTrak’s reputation intelligence software is always on, so we’ve been able to meticulously track reputation evolution across industries, through 2020 and 2021 and heading into 2022. And while we saw some industries flourish under 2020’s unique circumstances (see Pharma), one industry surprised us in its downturn: Retail.

Read our full Retail 2021 Reputation Report here.

In March 2020, The RepTrak Company conducted a custom COVID-19 study and found that 53% of the public believed Retail, as an industry, was at risk for disruption or damage to its reputation – and they were right. While they maintained a Strong Reputation Score through 2020, Retail’s Reputation Score decreased from a Strong Score of 70.6 in Q1 2021, to an Average Score of 69.1 (▼ 1.5) in Q2 2021.

While a 1.5-point decrease might not seem too dramatic, historical RepTrak research shows a 1-point drop often results in a 4-5% drop in support. And with a historically Strong Reputation Score in the past, this sudden Average swing caught our attention.

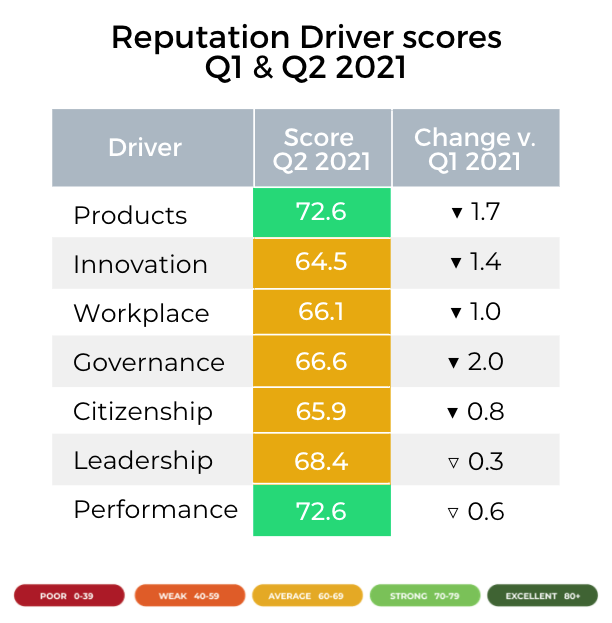

RepTrak’s Reputation Scores are determined by individual drivers (along with other factors). These seven key Drivers include Performance, Products/Services, Leadership, Citizenship, Conduct, Workplace, and Innovation. How these factors fluctuate give us key insight into how customer priorities evolve, and exactly where brands are succeeding and failing.

Upon closer examination, we saw a shift in customer priority in 2020 that carried into 2021.

Who’s driving who?

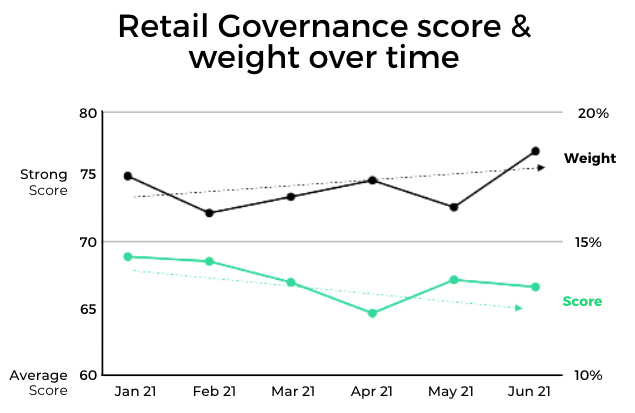

In 2020, Retail’s top 3 Drivers were Products, Conduct, and Citizenship. Since the beginning of 2020, Products decreased in influence, while Conduct and Citizenship increased. These Drivers maintained priority in 2021, with Conduct further increasing in importance in H1 2021 (+0.9pp), while its Driver Score lowered significantly QoQ (▼2.0), dragging Reputation Scores down with it.

At RepTrak, we define Conduct (formerly Governance) as a measure of a company’s ethical behavior, transparency, and fairness. Meanwhile, a company that scores high in Citizenship takes an active stand in aiming to make the world a better place, most frequently through environmental and social efforts.

These warm fuzzies are rivaling the very products Retail offers, demonstrating customer demand for a well-rounded brand.

Other notable Drivers include Innovation. In 2020, Innovation was Retail’s most improved Driver Score (+1.8). But when we look closer at Retail’s Drivers Quarter-over-Quarter, Innovation saw one of the biggest decreases.

In 2020, new or low-frequency shoppers increased their e-commerce purchases by 169% since the beginning of COVID-19. And in place of in-person shopping, 35% - 50% of consumers adopted services like contactless payment, home delivery, or curbside pick-up.

While these were welcome innovations, they lost their luster in 2021 when nothing further accompanied them.

This initial innovation was not enough to carry through to 2021 and risks further falling in 2022. Every ongoing trend starts as an initial shift.

Twenty-twenty is the year that simply won’t end. Its happenings forced a change in priority and perspective for customers — and Retail is not immune. Heading into 2022, customers want you to offer innovative solutions in an ethical manner. In fact, 63% of customers prefer to buy goods and services from companies that “stand for a purpose that reflects their values and beliefs” and will avoid those who do not.

You are more than the products you offer. Customers want to get excited by what you offer and comfortable with how you offer it.

As you look towards 2022, prioritize these fluctuations in Drivers. Your reputation depends on it.