Crisis in the Banking Industry: Declining Q2 Benefit of the Doubt Scores

Reputation Risk27 Jul, 2023

In the business world, few things are ever guaranteed — but a crisis is one. The data in our 2023 Corporate Benefit of the Doubt Report shows that stakeholders are tired of seeing their favorite brands get caught in one crisis after another. Benefit of the Doubt is one of RepTrak's Business Outcomes. It measures stakeholders' willingness to assume the best of a company if they were facing a crisis. Consumer awareness is on high alert after the past few years of seemingly endless crises, and in 2023, this Score is reflecting public fatigue with a 0.5-point decrease from the previous year.

Though they're bound to happen, the unpredictable nature of how and when crises arise can be scary without a reputational roadmap. Luckily, the RepTrak suite measures a variety of reputational elements in near-real time. And data that's "always-on" can get you safely out of the woods should you lose your way.

That consistent stream of data gives you the ability to track your business' recovery from a crisis, but also analyzes how entire industries are impacted by current events — whether they're at the epicenter of a crisis or not.

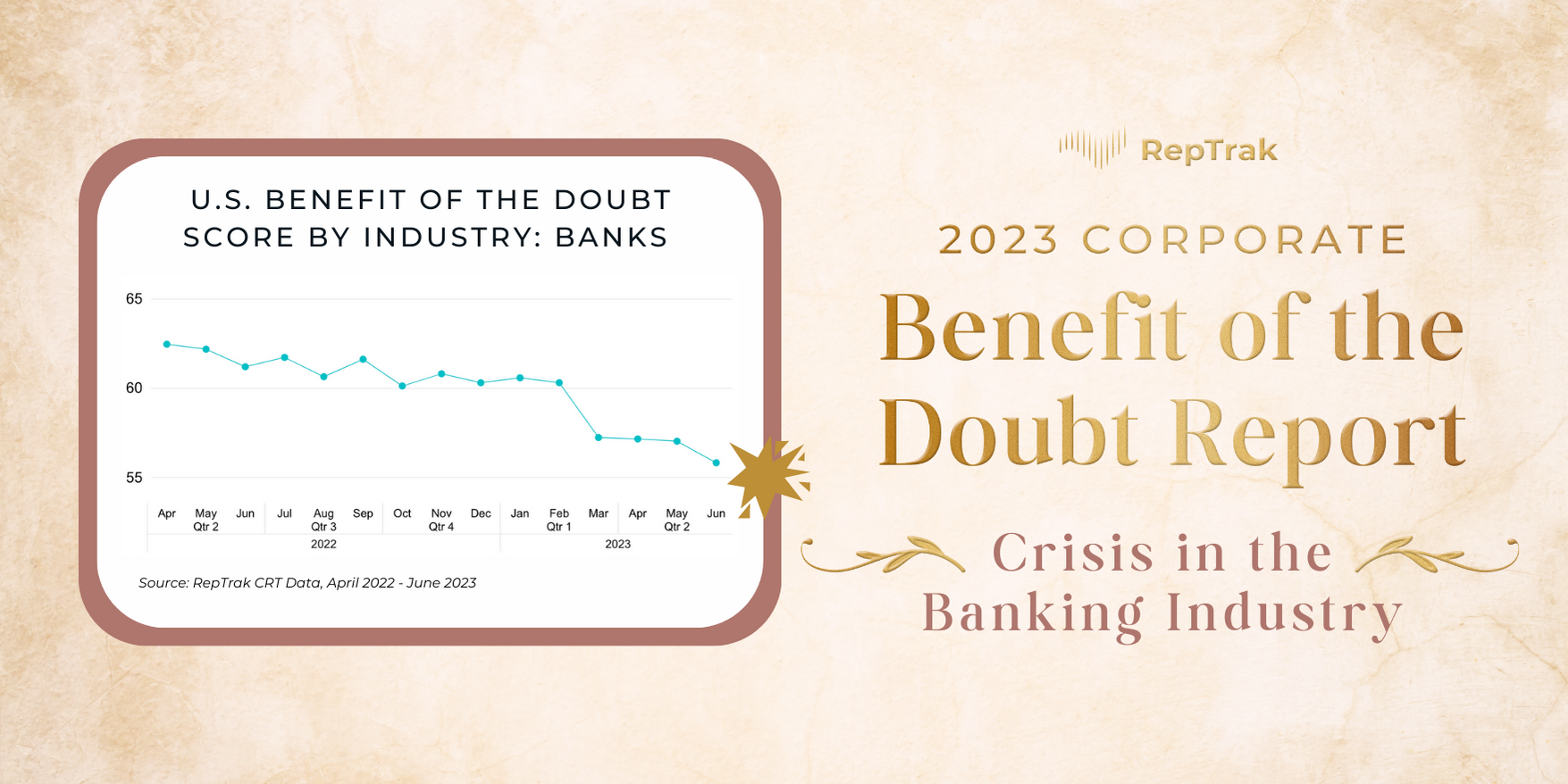

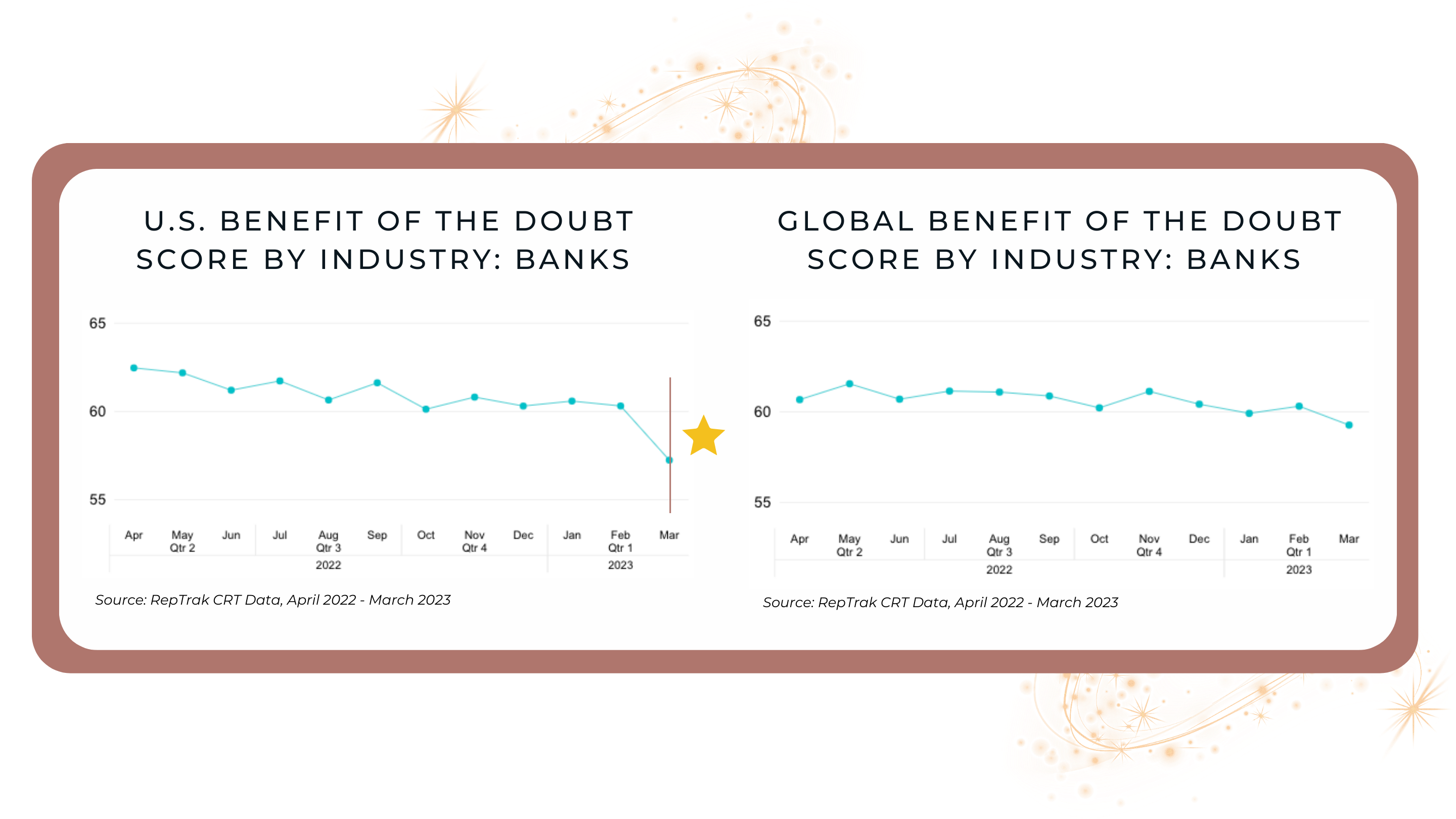

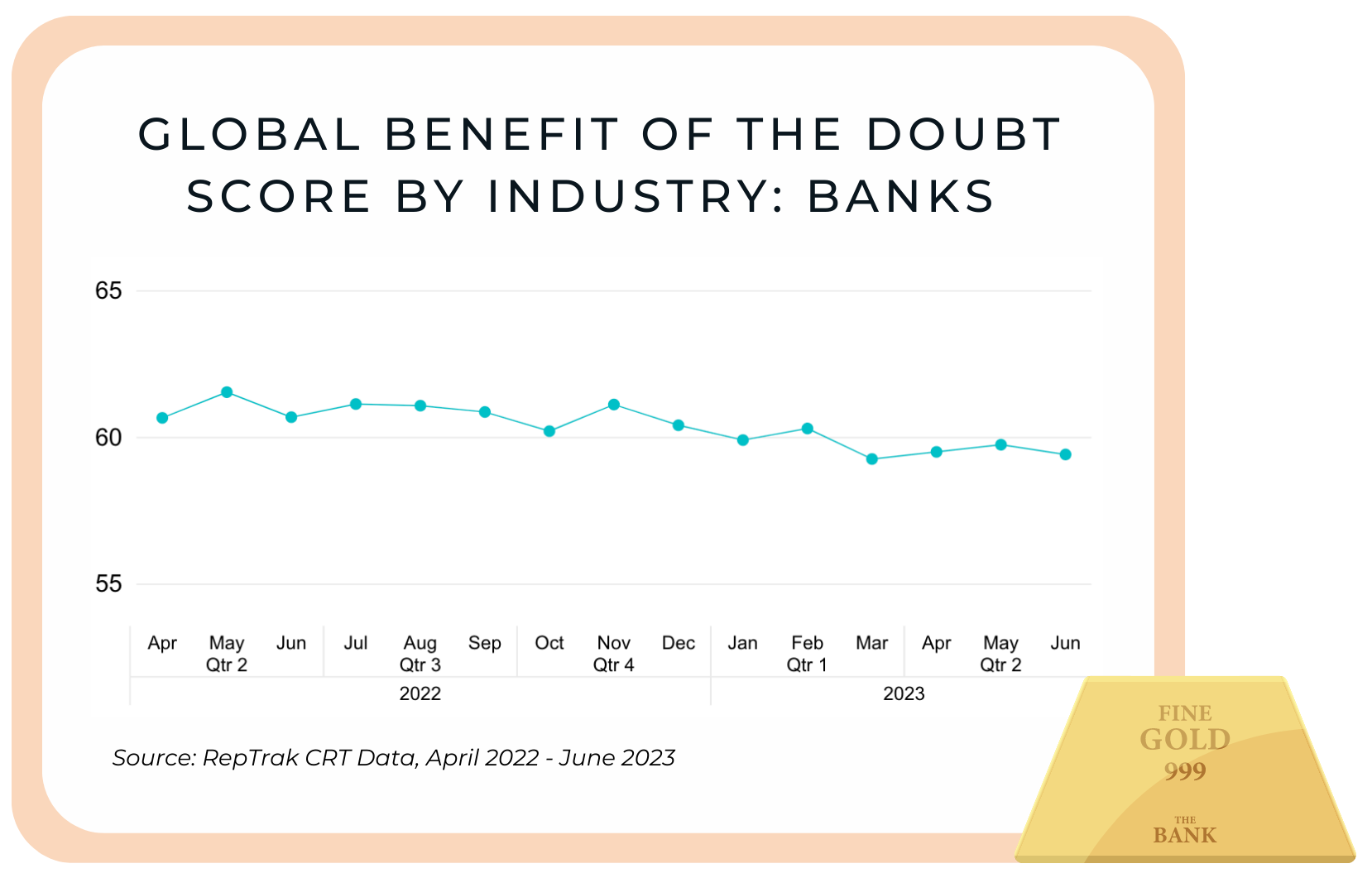

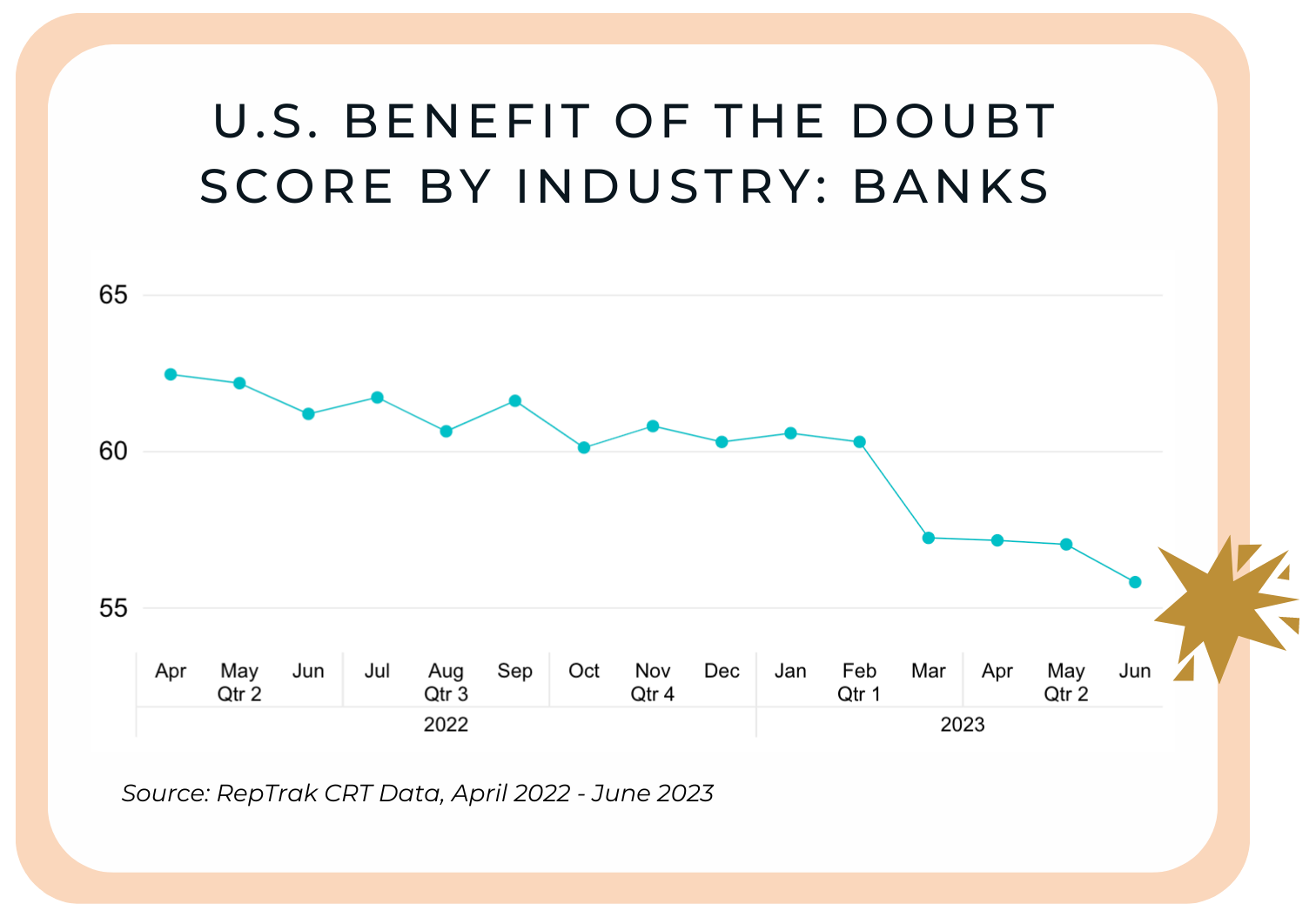

Most global crises are out of your control, but you are held accountable for your response as an organization. The same can be said for crises specific to an industry. RepTrak’s Industry insights show that not a single industry started 2023 with a Strong Score in Benefit of the Doubt. All of them dwindle in the Average range, with the exception of Banks and Telecommunication Services in the Weak range. Banks showed the second largest decline in Scores with a full 1-point decrease (behind Software and Services's 1.1-point decrease). In the United States, we see a much more dramatic decline in Scores, notably from February to March of 2023 following the crash of several U.S. banks. This was the largest bank failure since 2008. To prevent a global fallout, banks from around the world combined efforts with the U.S. Federal Reserve to provide swift liquidity to help stabilize the market.

Since the bank crash occurred at the beginning of March, our original report only showed data through Q1. And at the time, a crash in this Score was inevitable.

Because Data at RepTrak is ongoing, we told you we'd look forward to the Q2 industry data to see who had the benefit of the doubt after this industry crisis had passed. Now we can see that, globally, Benefit of the Doubt Scores are slowly but surely climbing their way back up. Global Scores ended Q1 at a Weak 59.2. Q2 Scores peaked at 59.7-points in May, but ended June at 59.4. Don't take these small increases for granted. You know what they say about reputation, "a lifetime to build, seconds to destroy." Even small growth means you're building back trust with stakeholders, which will help protect you later on.

In the United States, a different story is being told. Benefit of the Doubt Scores have gone from bad to worse for the Banking industry. The U.S. ended Q1 at a Weak 57.2, and by the end of Q2 they had dropped to 55.8-points. The Banking industry is rarely a trusted one in the eyes of stakeholders. High fees and higher interest rates don't make for widespread perceived popularity. While the bank crash may not have directly impacted every person who has a bank account in the U.S., continuing economic hardship and the perception of financial instability are lasting in the minds of consumers. Banks in the U.S. need to be communicating with stakeholders not just that their money is safe, but that they can trust banks to do right by them in the business relationship they have.

RepTrak Sales Director, Doug O’Brien, explains that “when a crisis occurs in one particular company, doubt can spread like wildfire across an industry.” Meaning that you’ve effectively lost the benefit of the doubt from stakeholders. Doubt, in this case, is the lack of stakeholder conviction in your company. "Doubt enables consumers to pass that crisis along to any company aligned with that industry — it’s guilt by association.” When one of your competitors is going through a crisis, O’Brien says, "to prevent the appearance of broken promises across the industry, you have to show your stakeholders the actions you’re taking to differentiate yourself from them. A tweet expressing collective solidarity isn’t going to cut it.”

A reminder that in the reputation game, perception is reality. And if you’re not telling your stakeholders otherwise, they’re going to see you as part of the larger collective problem.

Having the Benefit of the Doubt might not be a bottom-line KPI right now, but it’s a risk-management tool that you can depend on when the future of your business is at stake. Investing in these now is going to be worth it when a crisis hits. Eventually one will, and you don’t want to be without benefit of the doubt.

We think the story of Benefit of the Doubt could have a happy ending, do you?